Pix

PIX is a bank transfer payment method, built and owned by Brazilian Regulator and linked to over 700 Brazilian financial institutions. Shoppers can pay

More popular than Cards

+70% of all Brazilians use Pix in a frictionless experience.

Crucial for online sales growth

Pix increased our merchants' online sales by 20%.

The fastest growing payment method in Brazil

Between 2020-2022 Pix increased its participation in digital commerce sales by 1948%.

Features

Payment type

Real-time payments

Channel

Online

In-person

Availability

Brazil

Currencies

BRL for Settlement

BRL for Processing

Refunds

Partial refunds

Multiple partial refunds

Multiple partial captures

3D Secure

Chargebacks

Local entity required

Sales day payout

Recurring

Why should merchants offer Pix?

Pix is used by 150 million Brazilians that could become your potential customers. Besides being real-time and with 24/7 availability, businesses can get rid of intermediaries which means they become subject to less transaction fees.

Merchants receive payments instantly and can reinvest or use the funds to pay debts faster. Other payment methods, such as Boletos and Cards, have strict deadlines and the settlement is much slower.

Merchants are less prone to fraudsters since Pix can be used directly on smartphones and doesn't require a card password or an ATM. Additionally it has a robust safety mechanism developed by the Brazilian Central Bank.

Brazil has almost 250 million active smartphones. These devices give tremendous potential to digital payments, especially Pix, and fulfills the increasing Brazilian consumer purchasing preference for a quick and easy purchasing experience.

Frequently Asked Questions

Pix is an instant payment system developed by the Central Bank of Brazil. It allows users to transfer funds and make payments instantly, eliminating the need for traditional transfers that can take hours or days to process.

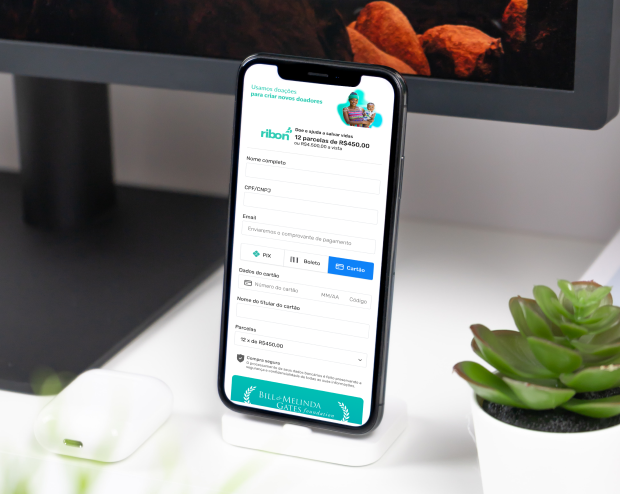

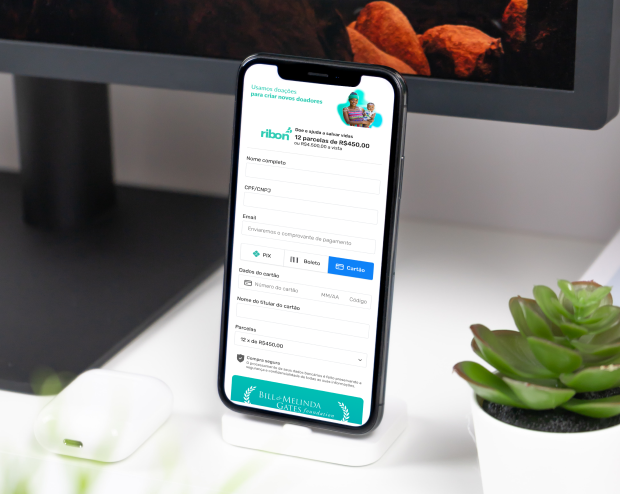

Pix utilizes unique identifiers called Pix keys, which can be a mobile number, CPF, email address, or an alphanumeric code. By providing the recipient's Pix key, users can initiate a payment within seconds, without the need for bank details such as agency and account number.

Pix offers numerous advantages, including instant transactions, enhanced security, and reduced transaction costs. It simplifies the payment process by eliminating intermediaries, allowing money to flow directly from the sender's account to the recipient's account within seconds.

To register for Pix, individuals and businesses need a transactional account with a financial institution such as a bank or fintech. The registration process takes place through existing banking channels, where users can select their desired Pix key. Participating financial institutions prominently display the Pix option in their platforms, ensuring easy access for users.

Yes, Pix is available to all individuals and businesses with a transactional account. It has the potential to foster financial inclusion by enabling unbanked individuals to participate in the payment system without requiring a traditional bank account.

Yes, Primefy allows international merchants to sell to Brazilians offering Pix as a local payment method.

Speak with our team

Discover the potential of the Brazilian market and start selling in days

No local entity needed

No setup fee